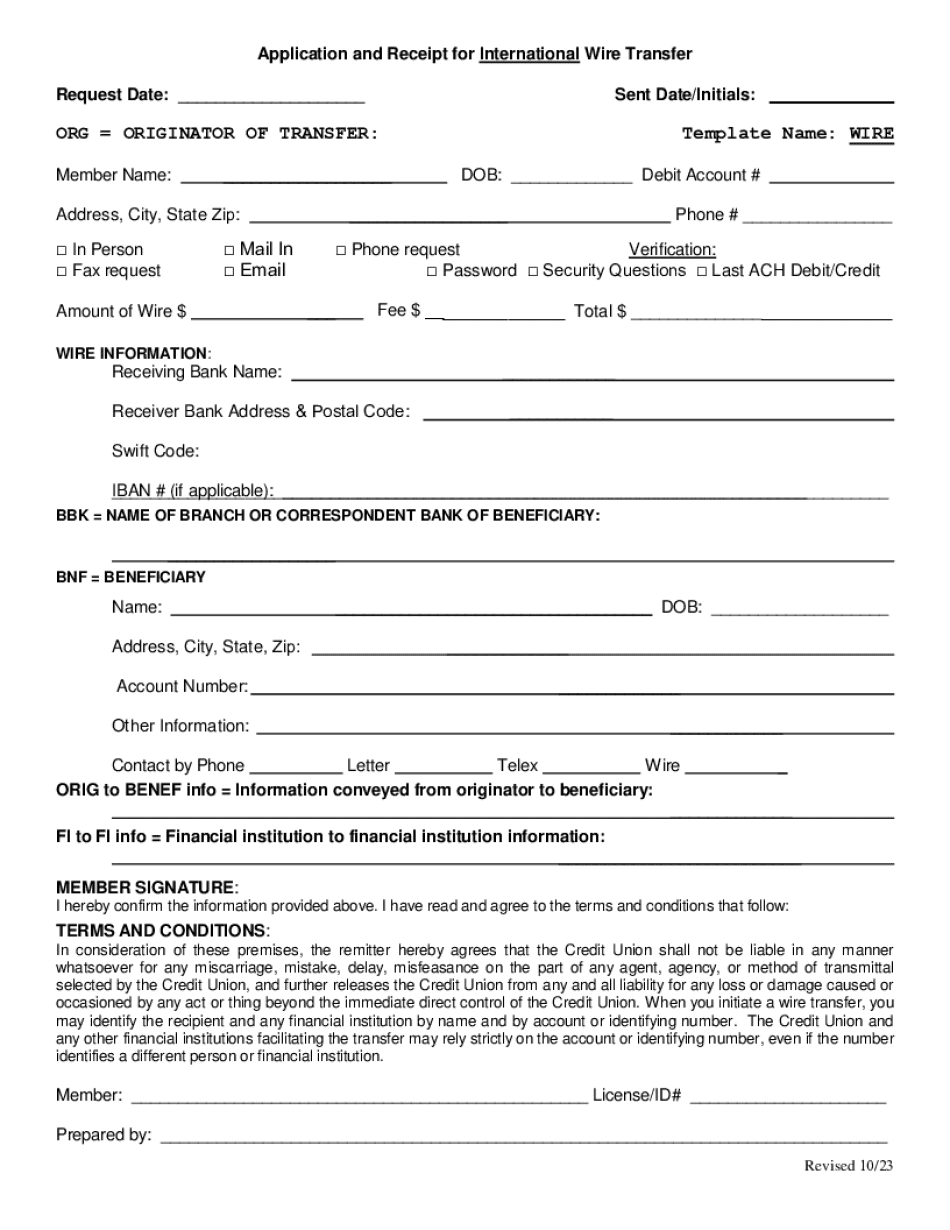

Hi and welcome to detail I'm Rebecca Bautista and in this video we're going to be going over wire transfers so let's get started all right so in the previous video we talked about ACH transfers now let's talk about wire transfers a wire transfer is another way to transfer money across accounts but it's a little bit different when you make really large purchases such as real estate a car sometimes transferring money through Estates Etc you need to move over thousands and thousands to up to hundreds of thousands of dollars depending on your situation in this case an ACH transfer usually cannot be done but a wire transfer can a wire transfer generally has higher limits but one fallback is the fact that you have to pay for a white transfer another thing is that wire transfers require more information than an ACH transfer so when you initiate for a wire transfer you go to a bank and generally they will request additional information including paperwork that you fill out needing the person's address just name account number routing number and in general a reason why but also they may request your driver's license to again prevent fraud now the reason why there's a little bit more paperwork involved is because once a wired transfer is initiated it cannot be stopped so you really want to make sure that your money is going to the right place so double check it as you fill out the form there are times where it is accidentally misentered and then it could take weeks to try to fix that so in general it's just something that once it's initiated it can't be stopped and that money will go to the account that was specified so once you specify an amount...

PDF editing your way

Complete or edit your online bank transfer receipt generator anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export Wire Transfer Receipt directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your Wire Transfer Receipt as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your Wire Transfer Receipt by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

What you should know about Wire Transfer Receipt

- International wire transfers require accurate and detailed information for successful processing.

- Wire transfer fees may vary based on the amount and destination of the transfer.

- Confirmation of wire transfers should be retained for record-keeping purposes.

Award-winning PDF software

How to prepare Wire Transfer Receipt

About Wire Transfer Receipt

A wire transfer receipt is a document that confirms the transfer of funds from one account to another through a wire transfer. It contains information about the transaction such as the amount transferred, the date and time of the transaction, the sender and recipient of the funds, and any additional fees or charges associated with the transfer. Anyone who sends or receives funds through wire transfer may need a wire transfer receipt. This includes individuals who transfer money to friends or family members, businesses that make payments to suppliers or vendors, and financial institutions that process wire transfers on behalf of their customers. Wire transfer receipts are important in providing proof of the transaction and can be used for record-keeping, tax purposes, and dispute resolution.

People also ask about Wire Transfer Receipt

What people say about us

Video instructions and help with filling out and completing Wire Transfer Receipt